Exclusive new research from data and insight consultancy, TWC, on the ARTD category within convenience reveals Scotland punches well above its weight in this vibrant and innovative category with premium brands shining bright.

By Sarah Britton

The Alcoholic Ready-To-Drink (ARTD) market within the Scottish local retailing sector is worth an almighty £59.3m, according to the latest data from TWC’s Smartview Convenience read. Despite a slight decline, down -1.1% YOY, Scotland’s share of the GB market still equates to a whopping 26%. When you consider that Scotland’s population is less than 10% of GB, the fact that it accounts for over a quarter of RTD sales is pretty impressive. Compare this, for instance, with Scotland’s value share of the total GB Beer market, which stands at a more proportional 10%.

In volume terms, ARTD sales are also down recently, -3.9% YOY in Scotland, but nevertheless the category still accounted for a substantial 18 million retail units in the year to June 2024, making up 23% of GB sales.

The average price per unit for ARTDs currently stands at £3.28, versus £3.19 the previous year.

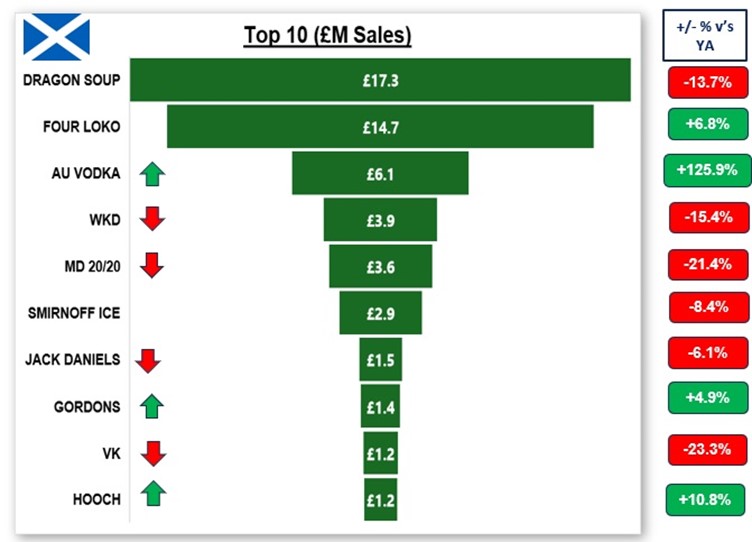

So which brands are top of the alcopops? It won’t come as a surprise to many to hear that Dragon Soop remains the leading brand in Scotland, racking up £17.3m sales in the 52 weeks to June 2024. The 500ml energy-alcopop hybrid has been commandeering Scottish retailers’ shelves for a number of years. The drink has a hefty 7.5% ABV, lowered from 8% to avoid paying higher taxes, and contains high levels of caffeine (35mg per 100ml), blended with taurine and guarana. Dragon Soop’s dominance, however, is under threat.

Exit the dragon?

While it remains market leader, the brand has however been experiencing a decline in recent times, according to the TWC data. Sales fell 13.7% in the last year, a drop of around £2.7m. Dragon Soop remains a key brand but the sheer volume of newcomers into the category has unsurprisingly taken its toll.

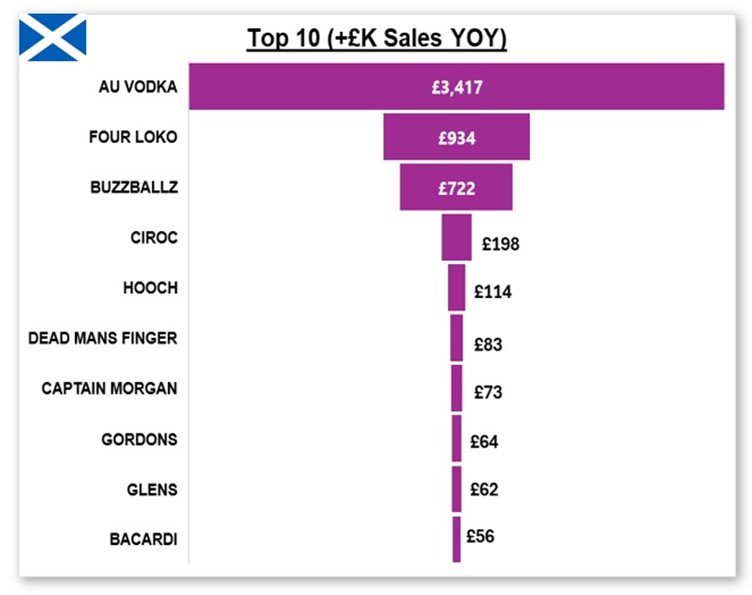

Key among the new kids on the block is Four Loko, which takes second place with annual sales of £14.7m. The brand has clocked up just under a million pounds worth of additional sales (+6.8%) YOY, making it the second biggest ARTD £ growth contributor in the country. Four Loko exploded onto the Scottish convenience scene in 2020 thanks in small measure to the efforts of Andy Ferguson of Red Star Brands, who had previously driven the huge success of Red Bull in Scotland.

At 8.5% ABV, the 440ml cans are unapologetically bold. “It’s not your everyday drink,” says Ferguson. “We like to think of it as a signpost, a statement of intent, the perfect way to get a memorable evening off to a flyer.”

Midas touch

Scotland’s biggest ARTD £ growth contributor, AU, holds the number three slot in terms of sales value. The brand made the successful transition from premium spirit to ARTD in July 2022 when the initial release of cans sold out within a week and stores had to pre-order the products ahead of their return in August. The 5% ABV metallic cans of flavoured vodka and soda have – quite literally – proved to be a goldmine, valued at £6.1m, having grown an incredible 125.9% YOY, lapping up £3.4m extra sales.

Renowned for its gold packaging and multiple flavours, AU vodka has become a big name within convenience, often taking up multiple facings in spirits displays. The brand has brought a similar level of excitement into the ARTD market, with the recent launch of Pink Lemonade becoming the fifth addition to its 5% ABV line up, plus new 200ml nitro-infused 8% ABV Strawberry Daiquiri and Blue Hawaiian cocktails. “We’ve revolutionised the market by offering bar-quality cocktails in a convenient, portable and gold format, which are nitro infused to ensure an exceptionally smooth liquid with an incredible taste,” says the firm.

AU is also the biggest ARTD £ growth contributor in convenience in England and Wales, where it has risen 105.5% YOY and is the market leader, with a value of £25m. Last month, the brand claimed that more than one AU Vodka 5% ARTD can had been sold every second for the last 90 days, equating to 95,855 a day.

In terms of value sales, AU is followed by WKD (£3.9m), which rose to fame in the mid-90s; ARTD veteran MD 20/20 (£3.6m), which has been rumbling around since the 70s; Smirnoff Ice (£2.9m), which hit the scene in 1999; and Jack Daniel’s (£1.5m), which made its Cola ARTD debut in 1991 and then combined forces with Coca-Cola to launch a dual-branded pre-mix last spring. The final three top 10 spots are taken by Gordon’s (£1.4m), VK (£1.2m) and Hooch (£1.2m).

Vodka-based RTD brand Four Loko has just unveiled its latest Pink Melon variant.

Aiming to appeal to Gen Z and Millennials, caffeine-free Pink Melon (RSP £3.49 per 440ml can) blends high-quality vodka with natural summer fruit flavours at 8.4% ABV.

“The RTD category is currently experiencing rapid growth, with vodka-based drinks within RTDs enjoying over 37% share,” said Clark McIlroy, Managing Director of Four Loko distributor Red Star Brands. “It’s a great time for retailers to maximise the opportunities associated with this demand, especially as Four Loko is renowned for being the go-to choice for those seeking full-on fun and flavour.”

New trends

But Dragon Soop isn’t the only big player to be bleeding sales in Scottish convenience. Other top 10 brands that are also witnessing value declines include MD 20/20 (-£975k), WKD (-£717k), VK (-370k), Smirnoff Ice (-£262k) and Jack Daniel’s (-£98k). TWC Category Insight Manager Elaine Baker says: “A lot of the well-established ARTDs, may be high up the ranking in £ value but are suffering in terms of £ losses with new, more exciting entrants into the market.”

With Dragon Soop coming in at 3.75 alcohol units per serve, while Four Loko delivers 3.74 and the biggest ARTD £ growth contributor brand, BuzzBallz, offering 2.7 units per serve, there’s no denying that high alcohol content is part of what is driving the market.

“Some of the biggest brands in £ value ranking or in £ growth contribution have higher ABV/alcohol units per individual serve,” observes TWC’s Baker. “There is a trend here in terms of strong.”

But there is also a move towards premium with Ciroc, Dead Man’s Fingers, Gordon’s and Captain Morgan all featuring in Scotland’s top 10 ARTD £ growth contributors.

With both high alcohol content and premium SKUs fuelling the ARTD market, it looks like there’s plenty to play for in 2024.

Retailer view

Kirkcaldy Linktown Local retailer Faraz Iqbal claims that AU is flying at his store. “AU ARTDs have been great, they’re a top seller for me” he says. “A lot of people see it as a premium brand. People see the gold can and it’s perceived to be the good stuff’,” he says. Four Loko and Dragon Soop also perform well in store, but Faraz views these as a separate sub-category. “Four Loko and Dragon Soop are high-strength ARTDs, in bigger cans. I keep them on a separate shelf,” he says. “The premium brands, like AU and JD & Coca-Cola, are blocked together.”

Co-op is looking to cash in on the premium ARTDs opportunity, having recently announced the launch of a 94-store trial of new BWS chillers dedicated to single-serve cans featuring ARTDs, craft beers, ciders and wine, in a bid to grow its share of the ‘on the go’ category.

The retailer’s trial offers a “carefully chosen” range of drinks, including Jack Daniel’s, Manchester Gin, MOTH cocktails and Ciroc ARTD brands.

Rebecca Oliver-Mooney, Co-op Head of Drinks, says: “This is a category that over-indexes on innovation and our curated range looks to balance core member and customer favourites with premium and innovative lines that will drive interest and excitement in-store.”

SmartView Convenience I-TG International Services Ltd in partnership with TWC. Value sales, 52w Jun 24. SmartView Convenience is a reflective market read of wholesaler-supplied Symbol and Independent Convenience stores across GB, it excludes Multiple Retail Convenience operators as well as Spar and Co-op.

SmartView Convenience I-TG International Services Ltd in partnership with TWC. Value sales, 52w Jun 24 SmartView Convenience is a reflective market read of wholesaler-supplied Symbol and Independent Convenience stores across GB, it excludes Multiple Retail Convenience operators as well as Spar and Co-op.