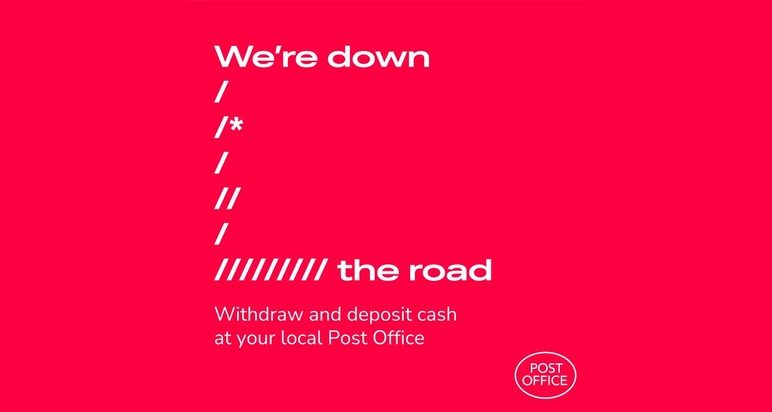

July saw a new record for Post Office cash handling with cash deposits and withdrawals hitting £3.77bn for the first time in a single month. The warm weather played a part in the increase, while the global Crowdstrike IT outage, which impacted banking services, meant Post Offices saw a 13% surge in cash withdrawals on 19 July. On the day of the software failure, Post Office was quick to flag up to customers that cash withdrawals and deposits could be made at their local branch with a tongue-in-cheek social media post (pictured).

Post Office cash handling figures for July beat the previous record high of £3.57 bn, set in May 2024, by £200m.

Scotland saw double digit YOY growth in cash deposits value, up +12.6% annually to £187.4m, and MOM sales were also up 9.4%. Meanwhile, Scottish cash withdrawals also increased, up +5.3%MOM and +8.3% YOY to £63.9m, bringing the total value of cash handling for July 2024 to £250.3m.

UK Business cash deposits totalled £1.24bn in July and this was the first time on record that business cash deposits have exceeded £1.2bn. Business cash deposits were up 10% MOM (£1.13bn, June 2024) and up 9% YOY (£1.14 bn, July 2023).

Personal cash deposits totalled £1.58bn in July and this was the first time on record that personal cash deposits have exceeded £1.5bn. Personal cash deposits were up over 11% MOM (£1.42bn) and up 17.6% year-on-year (£1.34bn, July 2023).

Personal cash withdrawals totalled £917m in July, up 8% MOM (£848m, June 2024) and up 12.5% YOY (£815m).

Ross Borkett, Banking Director at Post Office, said: “Our figures indicate that demand for cash is as strong as ever as people rely on cash to budget and businesses rely on it to survive a volatile trading environment. Postmasters and their teams play a vital role in supporting small businesses to trade by providing a convenient and secure location to deposit their cash takings with many branches open long hours and some at weekends. We are pleased that the Financial Conduct Authority have recently published new access to cash regulations to give both consumers and businesses more certainty around the future of cash.”